Difference between revisions of "GOVERNMENT REPORTS"

From SPGC Document Wiki

(→XV. Monthly Taxes Withheld on Compensation) |

|||

| Line 152: | Line 152: | ||

[[File:monthlytax.JPG|center]] | [[File:monthlytax.JPG|center]] | ||

| − | <center>''Figure | + | <center>''Figure 15.0''</center> |

Revision as of 15:02, 26 February 2019

Main Page > Application Development Team > System Manual > SPGC EPAYROLL >REPORTS TAB >GOVERNMENT REPORTS

Contents

- 1 I. Employee/Employer Contribution

- 2 II. SSS and HDMF Loan Summary

- 3 III. EPF

- 4 IV. MCL

- 5 V. NEW SSS FORMAT

- 6 VI. SSS Loan

- 7 VII. SLAC SSS

- 8 VIII. HDMF Contribution

- 9 IX. HDMF Loan

- 10 X. Simul HDMF Contribution

- 11 XI. Tec HDMF Loan Seq

- 12 XII. PhilHealth

- 13 XIII. New PhilHealth Format

- 14 XIV. Taxes Payable (BIR-Internet) with 13th Accrual

- 15 XV. Monthly Taxes Withheld on Compensation

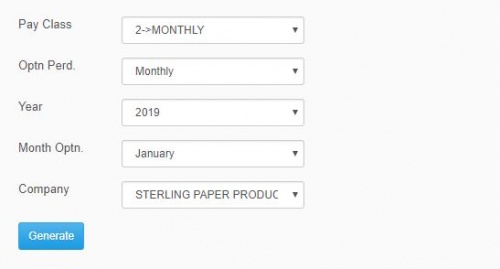

I. Employee/Employer Contribution

*In Employee/Employer Contribution, the user will select the type of pay class, optn perd, year, month optn, company and click generate button to view the reports.

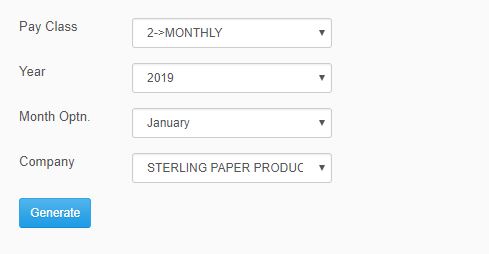

II. SSS and HDMF Loan Summary

*In SSS and HDMF Loan Summary, the user will input pay class, year, month optn, company and click generate button to view the reports.

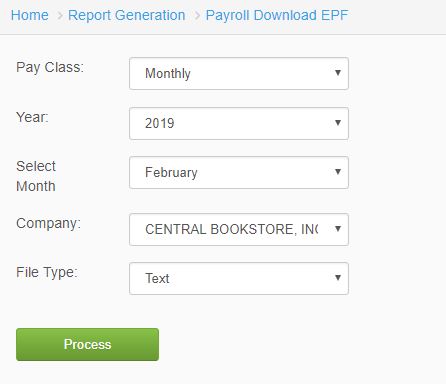

III. EPF

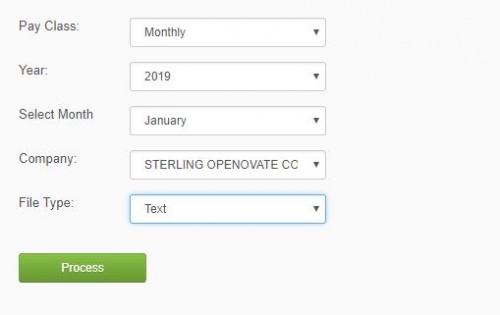

*In EPF, the user will select which type of pay class, year, month, company, file type and click process button to generate button the reports.

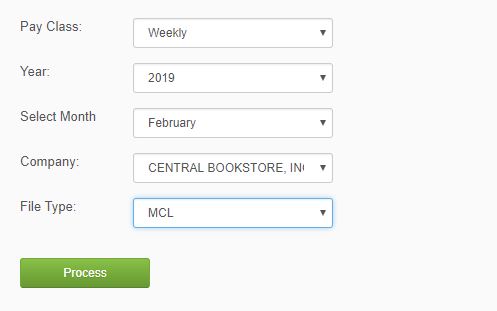

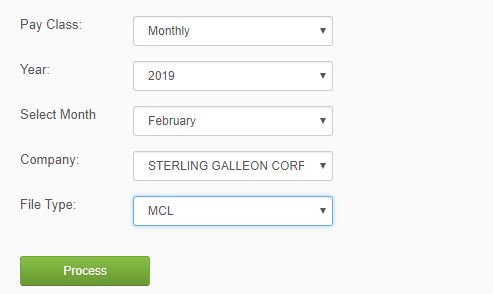

IV. MCL

*In MCL, the user will select pay class, year, month, company, file type and by clicking process button it will generate the reports.

V. NEW SSS FORMAT

*In order to generate the new sss format, the user will select the pay class, year, month, company and file type. Click the procss button.

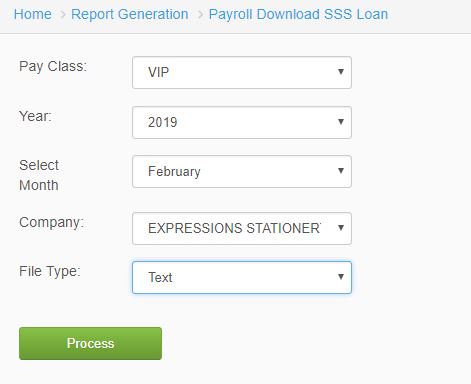

VI. SSS Loan

*In SSS Loan, the user will select type of pay class, year, month, company, file type and click process button to generate report.

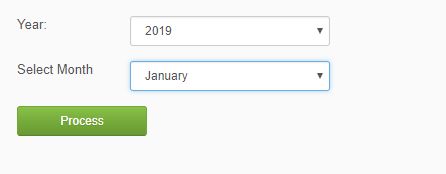

VII. SLAC SSS

*In SLAC SSS, the user will select the year and month to view report. Click process button to generate report.

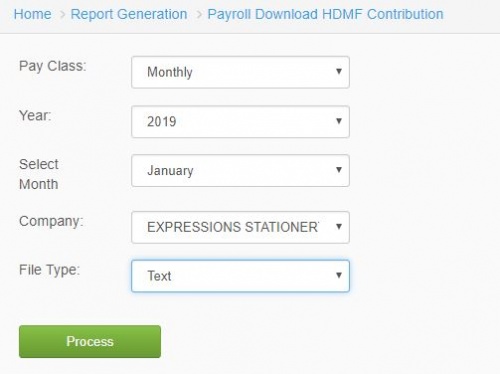

VIII. HDMF Contribution

*In HDMF Contribution, the user will select the type of pay class, year, month, company and file type. Click process button to generate report.

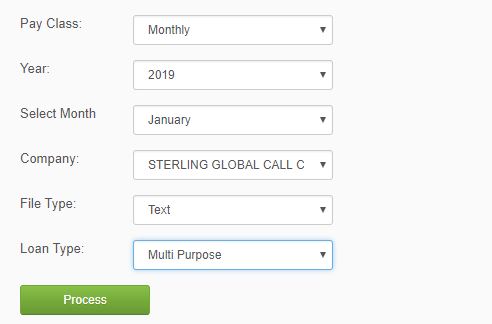

IX. HDMF Loan

*In HDMF Loan, the user will select the type of pay class, year, month, company, and file type. Click process button to generate report.

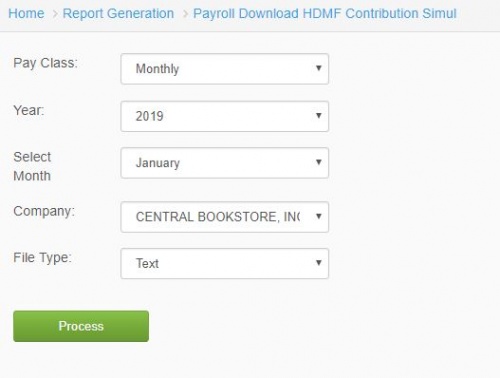

X. Simul HDMF Contribution

*In Simul HDMF Contribution, the user will select the type of pay class, year, month, company and file type to view report. Click Process button to generate report.

XI. Tec HDMF Loan Seq

*In order to view report of Tec HDMF Loan Seq, the user will select the type of pay class, year, month, company, file type. Click process button to generate report.

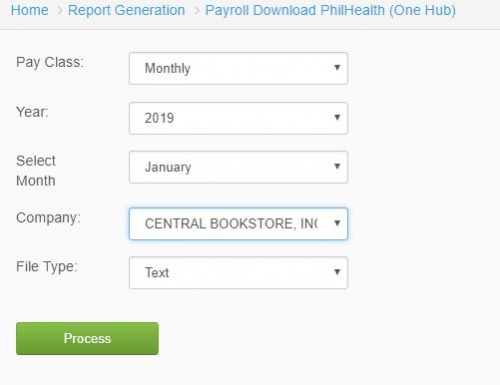

XII. PhilHealth

*To view PhilHealth report, the user will input the type of pay class, year, month, company, and file type. Click process button to generate report.

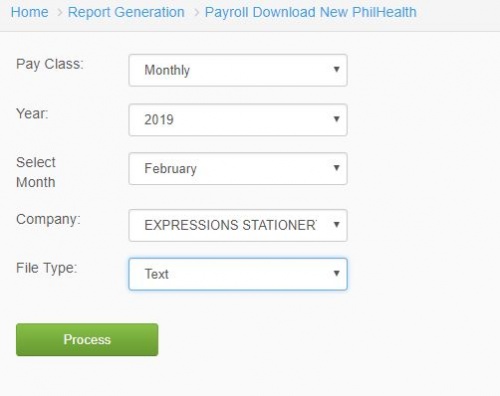

XIII. New PhilHealth Format

*In order to view New PhilHealth Format, the user will select the pay class, year, month, company, and file type. Click process button to generate the report.

XIV. Taxes Payable (BIR-Internet) with 13th Accrual

*In Taxes Payable, the user will select the year, month, company and option to view report. Click process button to generate report.

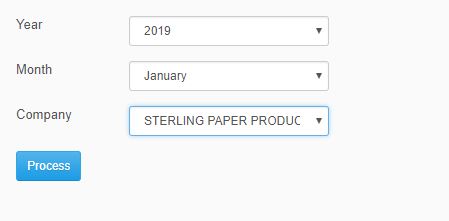

XV. Monthly Taxes Withheld on Compensation

*In Monthly Taxes Withheld on Compensation, the user will select the year, month, company of the employee to view report. Click process button to generate report.

REFERENCE: Media:Government Reports.docx

Main Page > Application Development Team > System Manual > SPGC EPAYROLL >PAYROLL SYSTEM >PAYROLL REPORTS