Difference between revisions of "TRANSACTION ENTRY"

From SPGC Document Wiki

| Line 147: | Line 147: | ||

125 713 ESSI COOP PENALTY D | 125 713 ESSI COOP PENALTY D | ||

126 714 KAMPIL-LOAN D | 126 714 KAMPIL-LOAN D | ||

| − | 127 | + | 127 715 SECURITY BANK LOAN D |

128 716 ASIA UNITED BANK LOAN D | 128 716 ASIA UNITED BANK LOAN D | ||

129 717 DONA MARIA RICE SURPRISE D | 129 717 DONA MARIA RICE SURPRISE D | ||

Revision as of 10:42, 20 March 2018

Main Page > Application Development Team > System Manual > SPGC EPAYROLL

Salary Adjustment

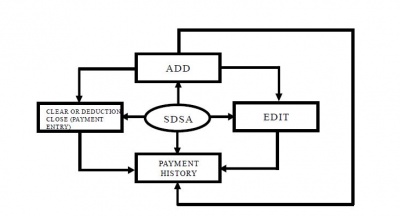

Process Summary

• When you want to Add an SDSA entry, these are the things that you should know:

o SALARY DEDUCTION AND SALARY ADJUSTMENT CODES

TAXABLE

PRIORITY NO. CODE DESCRIPTION TYPE

1 001 SALARY ADJ (TAXABLE) A

2 302 UNION DUES/AGENCY FEE) D

3 006 PATERNITY LEAVE (TAXABLE) A

NON-TAXABLE

PRIORITY NO. CODE DESCRIPTION TYPE

1 101 SALARY ADJ A

2 111 N.ALLO. A

3 201 SALARY ADJ/RETRO (NON-TAXABLE) A

4 202 HDMF LOAN ADJ A

5 203 TAX REFUND/ADJ A

6 204 TAX DUE D

7 205 RETRO PAY A

8 206 PATERNITY LEAVE A

9 207 REIMBURSEMENT-TRANS. EXPENSE A

10 208 OVR/UNPYMT-SL/VL A

11 209 ADJ-TRANSPO/PER DIEM A

12 210 PER DIEM A

13 211 CELL CARD A

14 212 RENTAL-VEHICLES A

15 213 MDL/DENTAL-REIMBURSEMENT A

16 214 GASOLINE ALLOWANCE A

17 215 MOTORCYCLE ALLOWANCE A

18 216 LODGING ALLOWANCE A

19 217 Other Allow. A

20 218 TEC Meal Allowance (RM) A

21 219 TEC Meal Allowance (AM) A

22 301 UNION FUND D

23 303 ACCOUNTABILITY (OFFICE SUPPLIE D

24 400 RICE D

25 401 VALE-1 D

26 402 VALE-2 D

27 403 UNLIQUIDATED ADVANCES D

28 404 CAR LOAN AMORTIZATION D

29 405 CAR LOAN INTEREST D

30 406 CAR INSURANCE D

31 407 SSS OVER/UNDER ADVANCE A

32 408 PRODN DAMAGES D

33 409 CASHIER SHORTAGE D

34 410 LBR CHARGES D

35 411 INCENTIVE ADJUSTMENT A

36 412 CELLULAR UNIT D

37 413 TELEPHONE CHARGES D

38 414 TELEGRAM CHARGES D

39 415 UNRET SAMPLES D

40 416 ESSI BARATILLO D

41 417 MAKATI BARATILLO D

42 418 RETL STORE PURCHASES D

43 419 PURCHASES (CBS) D

44 420 PURCHASES (MKTI SHOWROOM) D

45 421 T-SHIRTS D

46 422 COMPANY UNIFORM D

47 423 ATM INITIAL DEPOSIT D

48 424 UNRET LOTTO GIFT CHECK D

49 425 ESCROW FUND D

50 426 ACCOUNT/RESIGNED EMPL D

51 427 CAR LOAN REGISTRATION D

52 428 TRAVELLING EXPENSES D

53 429 LOST ITEMS/DELIVERY DISC D

54 430 TEL/BANK CHARGES D

55 431 EXCURSION D

56 432 CGA PURCHASES D

57 433 SCRAP PURCHASES D

58 434 SPORTS UNIFORM D

59 435 UNIFORM SUSIDY A

60 436 ID REPLACEMENT D

61 437 UNLIQ. PCF/REV FUND D

62 438 CREDIT CARD (EXCESS) D

63 439 VALE-2 INTEREST D

64 440 RICE D

65 441 STORE LATE OPENING D

66 442 ESSI GIFT CHEQUE D

67 443 RENTAL APARTMENT D

68 446 VENTAJA D

69 447 MISC-PROMO ITEMS D

70 448 LAPTOP COMPUTER D

71 449 PREPAID BROADBAND D

72 450 EMPLOYEE SHARE FOOD FOR CHRIST D

73 452 EMPLOYEE SHARE HEALTH CARD D

74 453 Loop Charges D

75 460 TEL CHARGES ADD BACK FRM ADMIN A

76 501 SSS LOANS (SALARY) D

77 502 HDMF LOANS D

78 503 NHMFC LOANS D

79 504 SSS LOANS (CALAMITY) D

80 505 SSS LOANS (STOCK INVESTMENT) D

81 506 SSS LOAN CONDONATION D

82 509 Cashier Incentive A

83 510 PO Employee D

84 512 HDMF CALAMITY LOANS D

85 514 SSS SLERP D

86 601 UCPB LOAN D

87 602 MDL/DENTAL D

88 603 IDEAL VISION D

89 604 UCPB PENALTY D

90 605 UCPB ADJUSTMENT A

91 606 HSBC BANK LOAN D

92 607 TRAVELLING EXPENSES-MANDARIN D

93 608 SOLID BANK LOAN-INTEREST D

94 609 PS BANK LOAN D

95 610 RS BANK LOAN D

96 611 CHINA TRUST BANK D

97 612 INSURANCE-LIFE D

98 613 INSURANCE-SAVINGS PLAN D

99 614 OUTLET INCENTIVE A

100 615 RCBC SAVINGS BANK D

101 616 PBCOM LOAN D

102 617 GE MONEY LOAN D

103 618 GREPALIFE-INSURANCE D

104 619 PNB BANK LOAN D

105 620 EO OPTICAL D

106 650 YISHION SALE D

107 651 MARILAO BARATILLO D

108 652 MEYCAUYAN BARATILLO D

109 660 INSULAR SAVERS BANK, INC. D

110 689 STERLING RESIDENCES ONE D

111 699 MISC-OTHER CURRENT LIAB D

112 700 MISCELLANEOUS D

113 701 UNION DUES/AGENCY FEE II D

114 702 MARILAO CANTEEN 1 D

115 703 COOP LOAN D

116 704 MARILAO COOP D

117 705 MARILAO COOP INVESTMENT D

118 706 ESSI COOP SHARE D

119 707 ESSI COOP LOAN D

120 708 ESSI COOP-JOINING FEE D

121 709 PURCHASES (NUEVA) D

122 710 BIKE LOAN D

123 711 X'MAS GIVE AWAYS D

124 712 MISC. - OTHER CURRENT LIAB D

125 713 ESSI COOP PENALTY D

126 714 KAMPIL-LOAN D

127 715 SECURITY BANK LOAN D

128 716 ASIA UNITED BANK LOAN D

129 717 DONA MARIA RICE SURPRISE D

130 800 GOVT ADJUSTMENT A

131 803 RICE D

132 804 RESIDENCE CERT D

133 900 MISCELLANEOUS D

134 901 SDSA ADJUSTMENT D

135 902 SL OVER/UNDER PAYMENT A

136 903 VL OVER/UNDER PAYMENT A

137 904 CHRISTMAS CASH GIFT A

138 970 PNB LOAN D

139 980 COMPANY ID D

140 981 PAYCARD/CASH CARD D

141 982 NAME BADGE/PLATE D

142 990 EQUICOM SAVINGS BANK LOAN D

143 991 PHARMACIA NI DOK D

144 992 WILLY FARM DINORADO RICE D

145 993 UNLIQUIDATED ADVANCES SD D

146 994 COMMISSION ON S.C. A

147 995 VACCINATION D

148 996 INGLOT D

149 997 SAVINGS D

150 998 CHINA BANK SAVINGS D

151 999 HELD SALARY A

Note:

✓ All the SDSA which code starts w ith 100 and below are considered taxable except for 302.

✓ While all the SDSA which code starts with 100 and above are considered non-taxable except for 302.

o FIELDS:

✓ Principal Amount is the total amount of SDSA. It will be divided based on the Total Installment, that amount will be paid by the employee per cut-off.

✓ Actual Loan Amount is the total amount of loan of an employee.

✓ Balance shows the total balance of SDSA per employee.

✓ Unpaid shows the unpaid amount of an employee. This usually occurs when the salary of an employee is not enough to pay the SDSA payment per cut-off.

• When you want to Edit an SDSA entry, the system will show a search box wherein you can search for the SDSA information of an employee. Just search for the last name of the employee followed by a slash ‘/’.

Note: The user cannot edit information if the payroll was already computed. If an employee wants to pay his/her principal amount, the user can edit information using Payment Entry.

• When user clicks Open, the system will show list of employees’ unpaid SDSA.

• When user clicks All, the system will show list of paid and unpaid SDSA of the employees.

User's Manual

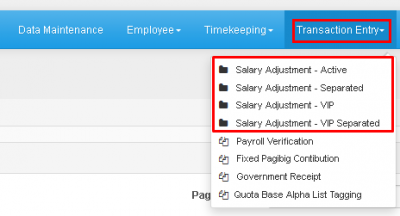

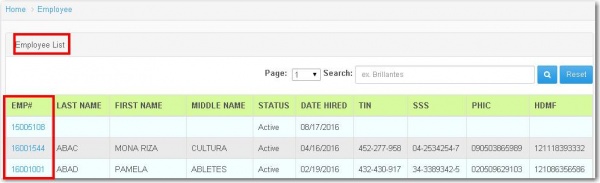

* Under the Transaction Entry is the Salary Adjustment which Manages Salary Adjustments Transaction.

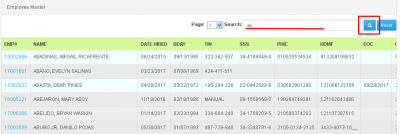

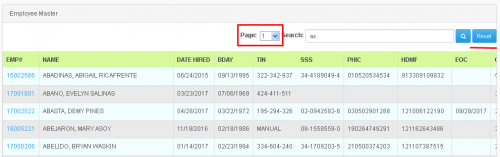

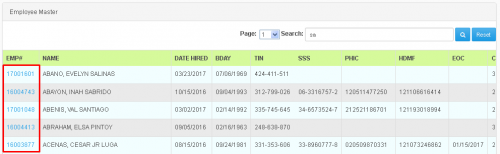

*Depending on what kind of Employee you'll search for, whether the Employee is Active, Separated, VIP, VIP separated. Press Salary Adjustment it will redirect you to the Employee Master Page. From there, the user can input the Emp. no./Name on the Textbox and by clicking the Search button, a list of Employees will appear on the list based on the info. entered in the text box.

*The Reset button is also included, by clicking the button, it will reset the searches and erase the results on the Emp. Master list.

*The Page Combo Box can be clicked (highlighted w/ red box), it will help you navigate freely from multiple pages of Employee Master list.

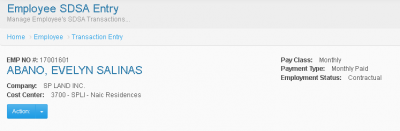

* When the user clicks on the Emp. No. at the left side, You will be redirected to Transaction Entry which indicates the Employees: Emp No., Class Type, Payment Type and the Employment Status.

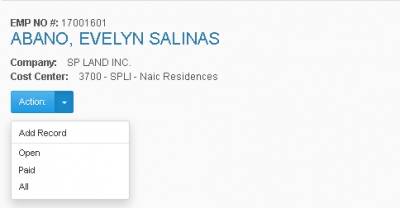

* Then when the user clicks on the arrow down on the Action, it will display the Open, Paid, All and the Add Record.

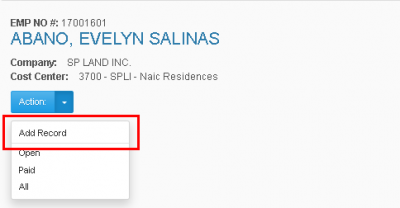

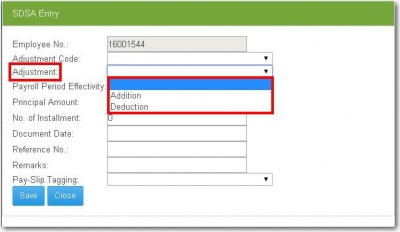

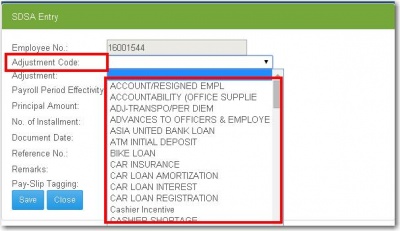

* When the user clicks on the Add Record

*The SDSA Entry will display, then the user is required input data in all entry. In Adjustment Code the user must select from the choices in the combo box.

*In Adjustment the user must select whether their choice is addition or deduction, then click the Save Button to record.

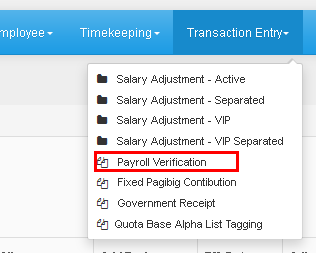

Payroll Verification

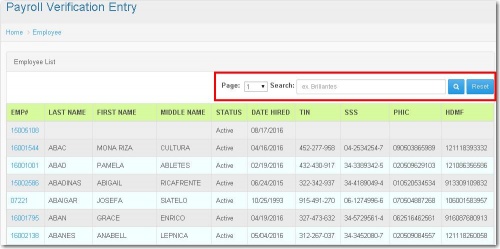

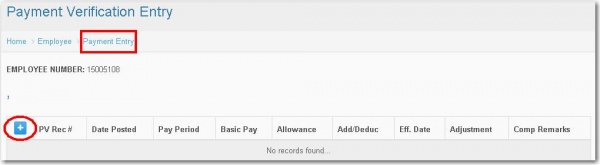

* Under the Transaction Entry is the Payroll Verification, then when the user clicks the button, it will display the Payroll Verification Entry

* When you click on the Payroll Verification it will display the Employee List which is the list of employee. The user can use the Page combo box which is the number of page for the list of employee. Then the user can also use the Search button to search employee name to easily found the employee. And the Reset button to go back to the main page of Payroll Verification

* When the user clicks the EMP #, The Payment Entry will display. The Employee Number that the user click will remain.

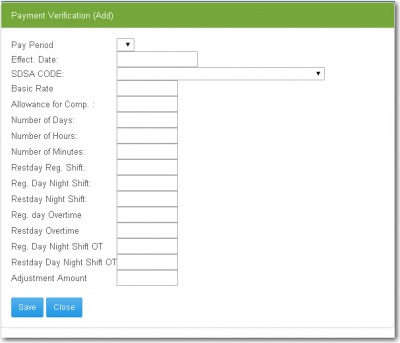

* When the user clicks on the (+), the Payment Verification (Add) will appear. The user should input a data in each entry. Including the Pay Period, Effect. Date, the SDSA CODE which can be selected in the combo box. Then the Basic Rate, Allowance for Com., Number of Days, Number of Hours and Number of Minutes. Next the Restday Reg. Shift, Reg. Day Night ShiftRestday Night Shift, Reg. Day Overtime, Restday Overtime, Reg. Day Night Shift OT, Restday Day Night Shift OT and the Adjustment Amount. After input the data in each entry the user can now click the save button then the records will be saved.

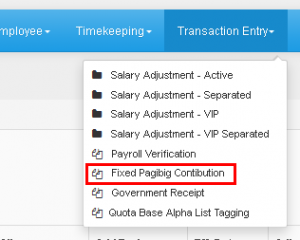

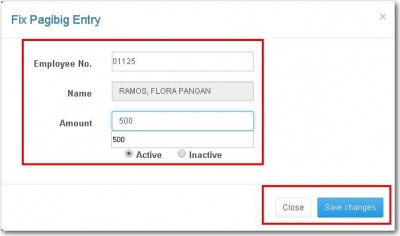

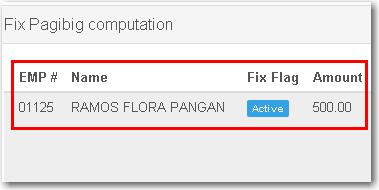

Fixed Pagibig Contribution

* Under the Transaction Entry, It includes the Fixed Pagibig Contribution. When the user clicks this entry it will display the Fix Pagibig Computation. The user can search the Employee Number on the search box.

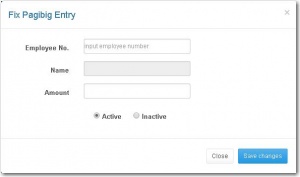

* When the user clicks the (+) , it will display the Fix Pagibig Entry, It includes the Employee No. Name and the amount.

* The user should input data for Employee No. Then the Name will automatically be displayed and then the amount and the user can select whether Active or Inactive.

* Then After the user input the data, the user now can click the save button then the records will display

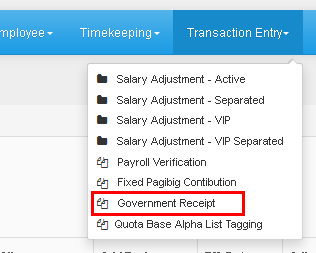

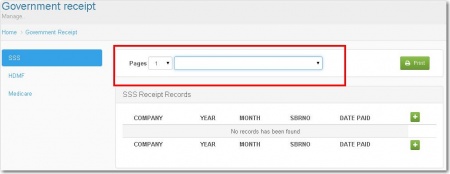

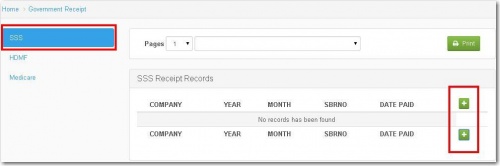

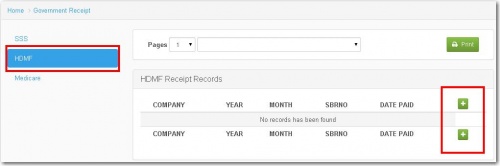

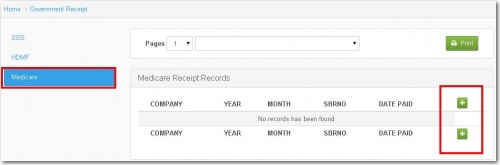

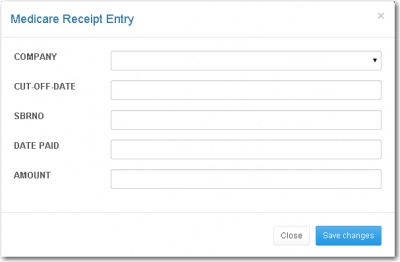

Government Receipt

* In Transaction Entry it includes the Government Receipt. The Pages, which is the number of pages, the user can use the combo box. The user can also select a company in the combo box besides the pages.

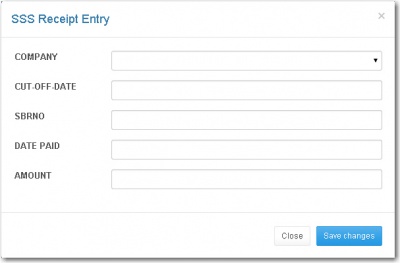

* It's like in the SSS When the user click on the (+), The SSS Receipt Entry will display. The users are allowed to input data to all entry. It includes the Company which can be selected, The cut-off-date, SBRNO, Date Paid and the Amount. After you input data you can now click the save button then the record will saved

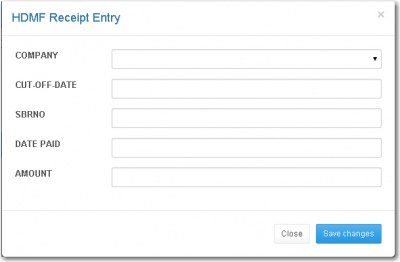

* It's like in the SSS When the user click on the (+), The HDMF Receipt Entry will display. The user are allow to input data to all entry. It includes the Company which can be selected, The cut-off-date, SBRNO, Date Paid and the Amount. After you input data you can now click the save button then the record will saved

* It's like in the SSS When the user clicks on the (+), The SSS Receipt Entry will display. The user are allowed to input data to all entry. It includes the Company which can be selected, The cut-off-date, SBRNO, Date Paidand the Amount. After you input data you can now click the save button then the record will saved

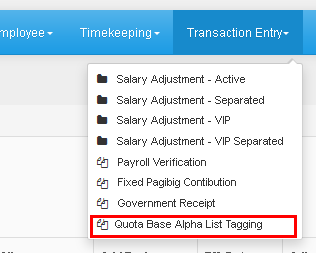

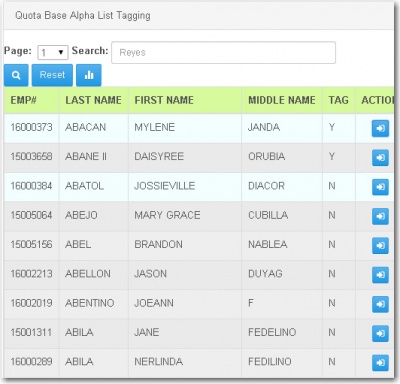

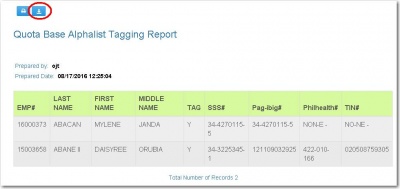

Quota Base Alpha List Tagging

* Under the Transaction Entry is the Quota Base Alpha List Tagging. The user can use the combo box for Page which the number of pages, for the ease navigation of the user through pages. Then the user can also use the search box to search the employee. And the reset button to go back to main page of Quota Base.

* This button is for Quota Base Alphalist Tagging Report, It will display the information of the employee you selected.

* This button allows the user to download a file in the Quota Base Alphalist Tagging Report. Besides it is the print, for printing the file.

* When the user clicks this button, the Alpha List Tagging will display. Which includes the Employee Number of the employee selected, Then the Name of the employee and question Included in the Alpahalist answerable with Yes or No. After that the user now can click on save button then the records will be save.

Reference

Main Page > Application Development Team > System Manual > SPGC EPAYROLL