Difference between revisions of "SDSA Code Applied Deduction-SLAC"

From SPGC Document Wiki

| Line 5: | Line 5: | ||

[[File:Encoding_per_deduction_slac.jpg|center|]] | [[File:Encoding_per_deduction_slac.jpg|center|]] | ||

| + | |||

| + | |||

| + | * After pressing Process, a window Pop-up will appear within it is the results, You may also download or print the results by pressing the button above, high lightened with a red box. | ||

| + | |||

| + | [[File:Sdd.png|center|400px]] | ||

[[Main_Page | Main Page]] > [[Application_Development_Team | Application Development Team]] > [[System_Manual | System Manual]] > [[PAYROLL_SYSTEM |PAYROLL SYSTEM]] > [[PAYROLL_REPORTS|PAYROLL REPORTS]] > [[SALARY_ADJUSTMENT | SALARY ADJUSTMENT]] | [[Main_Page | Main Page]] > [[Application_Development_Team | Application Development Team]] > [[System_Manual | System Manual]] > [[PAYROLL_SYSTEM |PAYROLL SYSTEM]] > [[PAYROLL_REPORTS|PAYROLL REPORTS]] > [[SALARY_ADJUSTMENT | SALARY ADJUSTMENT]] | ||

Revision as of 10:11, 28 June 2017

Main Page > Application Development Team > System Manual > PAYROLL SYSTEM > PAYROLL REPORTS > SALARY ADJUSTMENT

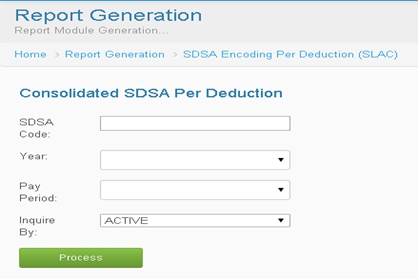

* SDSA Code Applied Deduction and SDSA Code Applied Deduction - SLAC has almost the same way on how the user input the data. Simply click the SDSA Code textbox then input, click the combo box for the Year, Pay Period and Inquire By and select. Then click Process button.

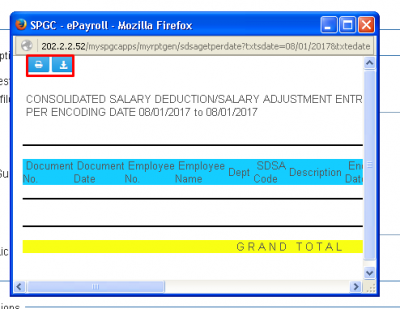

* After pressing Process, a window Pop-up will appear within it is the results, You may also download or print the results by pressing the button above, high lightened with a red box.

Main Page > Application Development Team > System Manual > PAYROLL SYSTEM > PAYROLL REPORTS > SALARY ADJUSTMENT