SALARY ADJUSTMENT

From SPGC Document Wiki

Main Page > Application Development Team > System Manual > SPGC EPAYROLL >REPORTS TAB

Contents

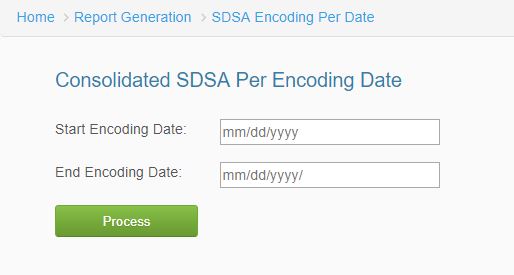

I. SDSA Encoding Per Date

*In SDSA Encoding Per Date, the user will input the start encoding date and the end encoding date to view report. Click process button to generate report.

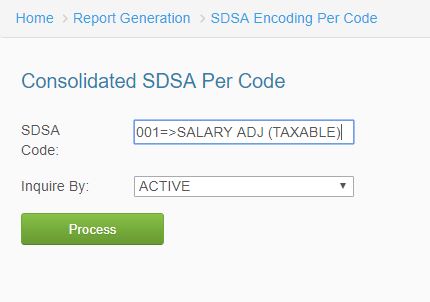

II. SDSA Encoding Per Code

*To view SDSA Encoding Per Code, the user will input the SDSA Code, and select which type of inquiry. Click process button to generate report.

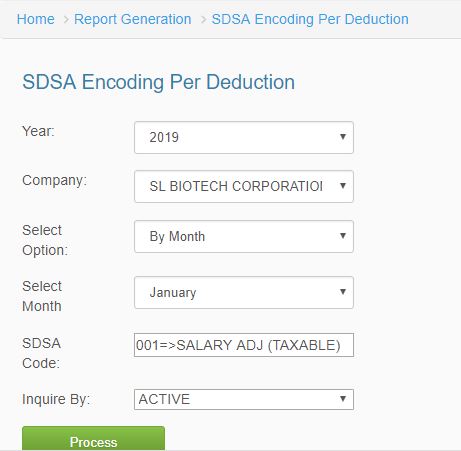

III. SDSA Applied Deduction

*In SDSA Applied Deduction, the user will select the year, company, options, month, input SDSA Code, and inquiry to view applied deduction. Click process button to generate report.

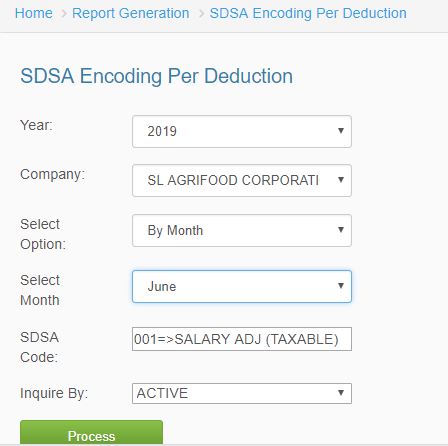

IV. SDSA Applied Deduction – SLAC

*In SDSA Applied Deduction – SLAC, select the year, company, select option, month, input SDSA Code, and select inquiry by of the employee to view report. Click process button to generate report.

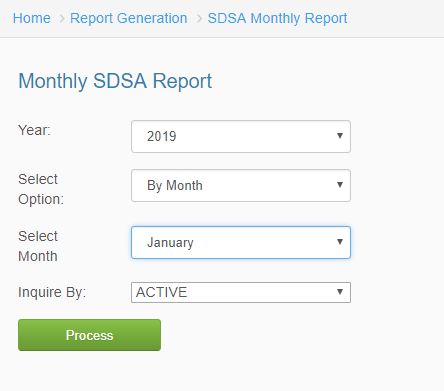

V. SDSA Monthly Report

*In SDSA Monthly Report, the user will select the year, select option, month, and the status. Click process button to generate report.

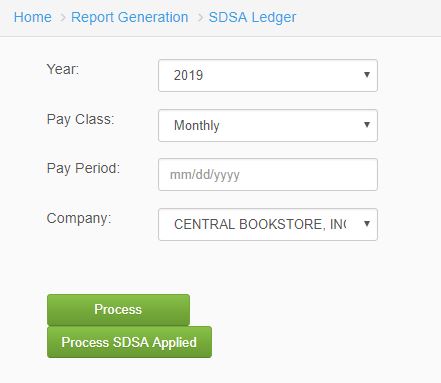

VI. SDSA Ledger

*In SDSA Ledger, select the year, pay class, pay period, company to view report. Click Process/Process SDSA Applied to generate report the user wants to view.

VII. SDSA Ledger – SLAC

*In SDSA Ledger – SLAC, select the year, pay class, pay period, and company. Click the process button to generate reports.

REFERENCE: Media:Salary Adjustment.docx

Main Page > Application Development Team > System Manual > SPGC EPAYROLL >PAYROLL SYSTEM > PAYROLL REPORTS